The title may jog memories for some readers. During the 1992 election cycle, advisor to then candidate Bill Clinton, James Carville, (running against George H.W. Bush) used the phrase for campaign workers as a charge to focus on. He wanted people to pay attention to the economic issues (inflation) affecting how people were feeling about the direction of the country.

This post isn’t meant to be political but the quote from Carville resonates. The August CPI numbers came out this morning and the news/data is not encouraging. For providers struggling with inflation, now rising energy costs heading into heating season, and high interest rates and constricted capital access, the tide is not turning and may be, temporarily worsening.

August inflation rose .6% over July and 3.7% for the twelve months since July 2022. Gas and fuel oil (diesel) were up 10.6% and 9.1% respectively. Fuel concerns me the most as it is a core commodity for agriculture and shipping, foretelling higher final goods prices at the market-end.

Food was up .02% or 4.3% for the 12-month period. Shelter (housing) was up .03% or 7.3% for the 12-month period. Removing energy and food, so called core inflation, the increase for the month was .03% and for the twelve-month period, up 4.3%.

The full CPI report is available here: August cpi

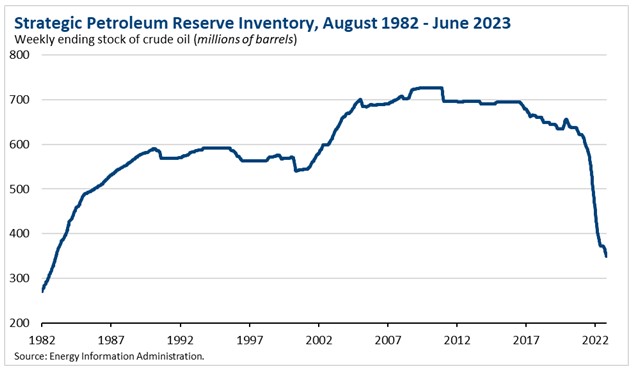

August was the biggest jump in over a year. Energy, primarily gasoline, had been dragging inflation down across the past twelve months. A major contributing factor to the drop in energy was President Biden’s release of oil from the Strategic Petroleum Reserve. The ability for continuous releases has waned and the reserve (remaining volume) is down 21% from a year ago. Simultaneous, OPEC Plus (including Venezuela) has cut production, decreasing overall world oil supply.

Of concern to most individuals, wages are not keeping pace with the current level of inflation. Average real household income is $76,330 per year and average spending is $73,000 per year. Savings rates continue to decline while credit card debt is rising, now over $1 trillion in balances due.

The measure of CPI is meant to be a reflection of what American’s spend money on. In 1981-1982, the index was based at 100. At the end of 2020, the index was 262. A year ago, the index had moved to 295. Today the index will be 305 or an increase of 16%.

While there is not a direct correlation between the index inflation and what providers are experiencing but it is close enough. I personally know that providers are not seeing 16% increases in reimbursements, off-setting rising costs. This means, that no different from individuals, reserves have dropped along with margins.

Looking forward, gas prices/oil prices are very close to the same level as one year ago. This means that Sept. inflation numbers are likely to inch higher again. Remember, inflation is cumulative and compounding meaning that while the rate of growth has slowed, it has not abated. For prices to decrease, inflation must move negative (deflation). As inflation remains elevated above GDP growth, prices become “sticky” meaning a drop is unlikely soon. And. with inflation above GDP, stagflation sets in. The remaining element that has not occurred for true stagflation to be present is rising unemployment (higher than normal trend).

So, for providers, today’s news is not good – No Bueno. I am an optimist but even with my general nature of optimism, I don’t see much in today’s numbers or recent economic numbers (consumer sentiment, labor reports, CPI, PPI, etc.) as encouragement. The slog continues.

I believe that the Federal Reserve will sit tight on rates as the factors driving inflation now are not mediated by rate increases (oil, finished goods prices, shelter and food). Policy decisions and current policy are that the root. The Fed further risks significant demand destruction with higher rates, pushing the economy into a hard recession. It can continue to allow the balance sheet to shrink thus, keeping downward pressure on the monetary supply (same impact, slower as interest rate increases). Basic definition of the Fed Balance Sheet is below.

The Fed’s assets consist primarily of U.S. Treasury notes and bonds and agency mortgage-backed securities. Its liabilities are mostly U.S. currency in circulation, bank reserves held in Fed accounts, and reverse repurchase agreements collateralized by Treasury securities.

Wishing all a Happy Hump Day! And yes, per James Carville, “It is the Economy, Stupid”….

Read 0 comments and reply