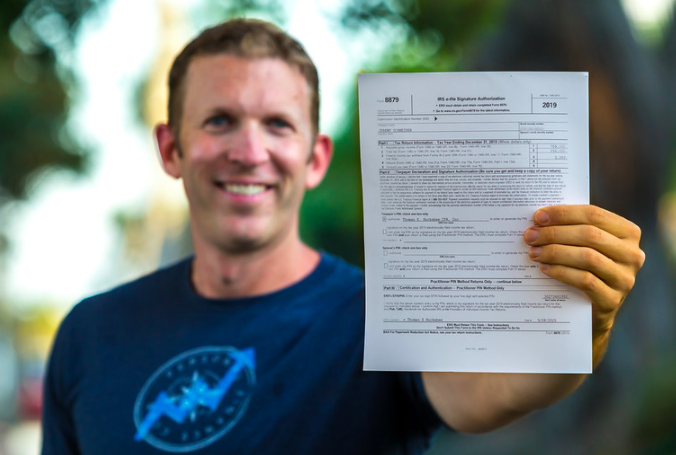

Hi, my name is Jeremy. I’m 39 years old and I’m rich.

My net worth is currently around $3.6 million.

Last year, my adjusted gross income was about $759,000 and I paid $152,000 in federal tax. (I’m rounding because sometimes exact tax numbers are used to verify your identity). That made my effective federal tax rate just over 20%. As a percentage of my income, I paid slightly less in tax than someone who made $72,000.

Let me be clear that I don’t wish for less money. I’m aware of many fantastic ways to have less money. I don’t even wish for higher taxes! That would be a silly wish. But I would like to live in a country with a more fair tax code. There are several reasons why the $152,000 I paid in federal tax last year was not fair.

Why did I pay less than someone who made $72K? Well, because I didn’t work for my money. My income last year was almost entirely capital gains. I sold a bunch of stock last year for more than I bought it for. That’s capital gains. The federal top tax bracket for earned income is 37%, but for capital gains, it’s 20%. That means if I worked my ass off as a fancy surgeon and brought home $759K, I would have paid about 35% of my income to the IRS. But, instead, I sat on my ass and posted to Instagram all day, letting my money make money. That lack of work saved me a cool $112,000 in tax.

It gets worse. I paid almost nothing into Social Security or Medicare. Capital gains are considered “unearned” income and are not subject to social security or Medicare tax. That $72K earner would have paid 7.6% of her income to social security and Medicare (and her company would have matched it with another 7.6%). The $759K surgeon? Only 3.2% of her earnings would go to social security and Medicare. Why is that? Because the social security tax drops to zero after $132K in earnings. Did you know that?! Social security and Medicare are the two biggest federal expenses, yet the tax to pay for them comes from income under $132K and is $0 on “unearned” income like I made.

Now you may be thinking, “Yeah, Jeremy, but you’re rich so you’re not going to need Social Security so why should you pay into it?” First of all, thank you for campaigning for my ability to further accelerate my wealth. That’s very nice. But if I got to pick and choose government programs that I pay for based on what I used, I’d have a long opt-out list. Why is supporting old poor people the one thing we stick only on the middle class?

You may also be thinking “But Jeremy, you’re a job creator. That money is going to feed the economy.” Maybe! Hopefully in the future, although I don’t currently employ anyone. That money is basically sitting in bank accounts and investments. Whereas if I (and other millionaires and billionaires) shouldered slightly more of the tax burden, while middle-class and low-income earners paid less. The extra money in their pockets would almost certainly all get spent (and taxed…since sales tax is yet another regressive tax), feeding right back into our economy.

So if we fixed the inequities described above and made it a “net neutral” change to total tax collected by passing a discount onto lower-income earners, I think that would be fairer. Even if I paid $100K more last year giving me an effective tax rate of 33%, I would have been left with $507,000 after tax. I’ll be okay.

~ Jeremy

P.S. And yes, I know that I can donate money to the federal government. But even if I gave them every penny to my name it would be meaningless without other high-income earners doing the same to lower the burden on lower-income earners.

~

Check out Waylon’s Instagram live with Jeremy for more on what he thinks about taxes:

Read 7 comments and reply